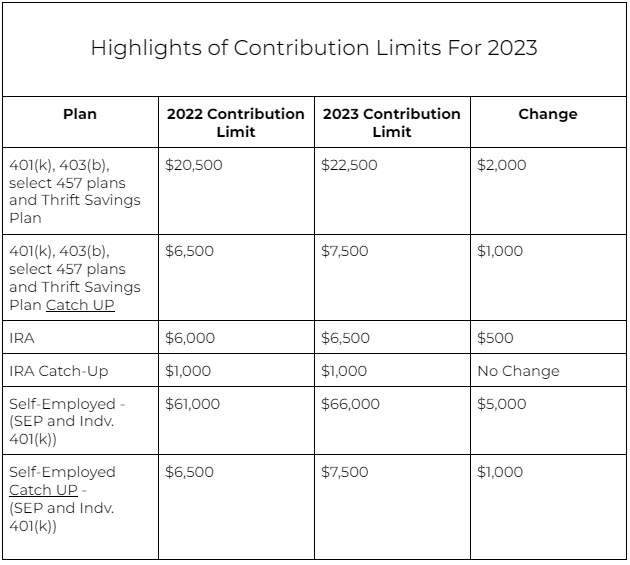

In the year of 2023, the annual contribution limit that has been presented for IRA is going to experience a sharp rise from $500 to an amount of $6500. Further, there is also going to be presented a thousand-dollar catchup amount for the contribution will be allowed for two individuals who are above the age of 50. Therefore the total maximum amount that is presented is $7500.

However, there might be several different changes and inclusions in your IRA contribution, and the list might vary depending on every individual. One great inclusion that has been made by the IRA is that if you are not working, but your spouse is working, then in such a case, your spouse can contribute to the IRA on behalf of you.

IRA contribution Limit

● The individuals who have a proper retirement account outside of their employee’s usual annual contribution have increased for their IRS. In the year of 2023, the most eligible individuals can contribute up to a sum of $6500, right from the amount of $6000 for their IRAs.

● In the year 2023, if the general outcome range for a single individual is in the range of $138000 to $153000. Then the individual who has a spouse can directly file jointly for a sum amount of $218000 to $228000.

● In the IRA, there is a particular income limit; therefore, if an individual is making a certain amount of income, then the threshold is eligible for a reduction in their total contribution.

IRA Exceptions

● There are several different exceptions that are made to the IRA contribution list. If you have ventured over to another retirement plan, such as the 401k from your previous employment and then into the IRA there, in such a case, the role of the plan will not be counted forward to your annual contribution limit.

● If there is a non working spouse without an income who can contribute to the IRA, then in such a case, you will not have to look for a particular taxable compensation. In such a case, you will be eligible to file for a joint return along with your spouse, who earns the income of the family.

● The individual is not allowed to contribute more than their earnings for their ira contribution limits 2023.

To Sum It Up

Have you followed through with your IRA plan? Every individual is required to follow through with an IRA. Therefore in order to entirely make sure that you are maintaining your proper IRA contribution, it is prime that you follow through with the latest ira contribution limits 2023.

Study through the following article in order to learn about your proper IRA contribution.