Introduction to Rare Silver Investment

Collecting rare silver bullion for sale has become more popular than ever. Many people want to buy rare silver coins because they offer something regular silver bars don’t. These coins combine precious metal value with historical significance. When you hold a rare silver coin in your hand, you’re touching a piece of history that also protects your wealth. The market for these coins continues to grow as more investors discover their unique benefits. Whether you’re new to precious metals or a seasoned collector, understanding what makes certain silver pieces rare can help you make smarter choices.

Why Rare Silver Differs from Standard Bullion

Most people know about silver bars and common silver rounds. But rare silver coins stand apart. These pieces often come from limited mintages or specific historical periods. Some were minted over 100 years ago. Others come from commemorative releases with only a few thousand pieces made. The difference matters because rarity adds value beyond the silver content. A standard one-ounce silver round might sell for $30. But a rare silver coin with the same weight could fetch $100 or more. The condition of the coin matters too. Coins graded by professional services typically command higher prices. Collectors pay premium prices for coins in mint state condition.

Understanding the Market for Rare Silver Bullion

The rare silver bullion for sale market operates differently than the general precious metals market. Prices depend on several factors. The silver spot price provides the base value. Then rarity, condition, and historical significance add extra value. Market demand shifts based on collector interest and economic conditions. During economic uncertainty, more people look to buy physical silver. This increased demand often pushes rare coin prices higher. The key is finding pieces that have both silver value and collectible appeal. Some coins serve as excellent inflation hedges while also offering potential appreciation beyond the metal value.

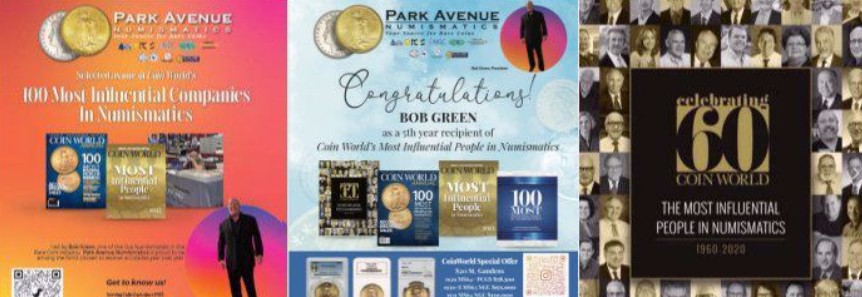

Park Avenue Numismatics: Your Trusted Source

When you want to buy rare silver coins, working with an established dealer makes all the difference. Park Avenue Numismatics has over 30 years of experience in rare coins and precious metals. They operate from Miami, Florida, and serve customers nationwide. The company specializes in helping both new and experienced collectors find quality pieces. Their team understands the nuances of grading, authentication, and market values. Park Avenue Numismatics offers secure private ordering with the latest online security processing. They never disclose customer information to third parties, making privacy a top priority. You can visit their website at https://www.parkavenumis.com/ to explore their current inventory.

Types of Rare Silver Worth Considering

Several categories of rare silver attract serious collectors. Pre-1965 U.S. silver coins contain 90% silver content. These include dimes, quarters, and half dollars that circulated for decades. Morgan silver dollars from the late 1800s remain highly sought after. Peace dollars from the 1920s also draw strong interest. Commemorative silver coins from various countries offer another option. These limited releases often feature beautiful designs and low mintages. Proof coins with mirror-like finishes command premium prices. Foreign silver coins from historical periods provide international diversification. Chinese pandas, Canadian maple leafs, and Australian kookaburras in special editions can become quite valuable.

How to Evaluate Silver Coin Rarity

Learning to assess rarity helps you make informed purchases. Mintage numbers provide the starting point. Coins with fewer pieces produced generally carry higher premiums. But survival rates matter more than original mintages. Many old coins were melted down over the years. The coins that survived become more valuable. Condition plays a huge role in pricing. Coins graded MS65 or higher sell for significantly more than coins graded MS60. Professional grading services like PCGS and NGC provide authentication and quality assessment. Key dates in specific series command the highest premiums. A 1909-S VDB Lincoln cent or 1916-D Mercury dime can sell for thousands of dollars.

Investment Benefits of Rare Silver Coins

Buying rare silver coins offers several advantages over standard bullion. First, you get intrinsic metal value. The silver content provides a floor price. Second, you gain collectible premium. This extra value can grow over time as coins become scarcer. Third, rare coins offer better liquidity than you might expect. Established dealers like Park Avenue Numismatics actively buy quality pieces. Fourth, these coins face lower counterfeiting risk than bullion bars. The intricate designs and specific characteristics make fakes easier to spot. Fifth, rare silver coins often appreciate faster than spot silver prices during bull markets. When silver rises, collector premiums typically expand.

Common Mistakes When Buying Rare Silver

New buyers often make predictable errors. Paying too much represents the biggest risk. Some sellers charge excessive premiums that the coins won’t support long-term. Always compare prices across multiple dealers. Another mistake involves buying cleaned or damaged coins. Cleaning reduces a coin’s value permanently. Scratches, dents, or corrosion also hurt resale value. Some buyers focus only on silver content and ignore collectible factors. This approach misses the point of rare coins. Others buy without authentication. Counterfeit rare coins exist in the market. Stick with graded coins from reputable services. Finally, some collectors buy emotionally without research. Study the coins you’re considering before making purchases.

Building a Balanced Silver Portfolio

Smart investors mix different types of silver holdings. Start with some standard bullion for pure metal exposure. Then add rare coins for collectible appreciation. Consider including various denominations and time periods. Pre-1965 U.S. silver coins offer fractional options for small transactions. Larger pieces like silver dollars provide impressive additions. Foreign coins diversify your holdings geographically. Modern commemoratives add contemporary appeal. The right mix depends on your goals and budget. Some experts suggest keeping 70% in bullion and 30% in rare coins. Others prefer a 50-50 split. Your personal situation should guide these decisions.

Storage and Protection Strategies

Proper storage protects your investment. Rare coins need more care than standard bullion. Never store coins loose where they can scratch each other. Use individual holders or capsules for each piece. Keep coins in a climate-controlled environment. Extreme heat, cold, or humidity can cause damage. A home safe provides basic security for smaller collections. Larger holdings might require bank safe deposit boxes. Some investors use private vault services. These facilities offer insurance and professional storage. Handle coins by their edges only. Oils from your fingers can damage the surface. Consider using cotton gloves when examining pieces. Keep detailed records of your purchases including prices, dates, and grades.

Selling Your Rare Silver Coins

Eventually, you might want to sell part of your collection. Timing matters when liquidating rare silver. Bull markets in precious metals create the best selling conditions. Collector demand peaks during these periods. Finding the right buyer ensures fair prices. Established dealers like Park Avenue Numismatics buy quality rare coins regularly. They understand current market values and pay competitive prices. Auctions work well for extremely rare or valuable pieces. Online marketplaces reach many potential buyers but require careful vetting. Document your coins’ authenticity before selling. Graded coins sell faster and for better prices. Clean transactions with proper documentation protect both parties.

Current Market Trends in Rare Silver

The rare silver market shows interesting patterns in 2025. More young collectors have entered the hobby. They bring fresh energy and different collecting preferences. Modern commemoratives see growing interest from this demographic. Traditional series like Morgan dollars maintain strong demand from established collectors. Graded coins continue commanding significant premiums over raw coins. Authentication concerns drive buyers toward professionally graded pieces. Economic uncertainty pushes more investors toward hard assets including rare silver. International buyers increasingly participate in the U.S. market. Online sales have expanded dramatically while maintaining quality standards. These trends suggest continued strength in the rare coin sector.

Authentication and Grading Explained

Understanding coin grading helps you buy smarter. The Sheldon scale runs from 1 to 70. Poor (P-1) describes barely identifiable coins. Mint State (MS-60 to MS-70) indicates uncirculated condition. Proof coins receive separate PR grades. Third-party grading services examine coins under magnification. They assess strike quality, luster, and any impairments. The final grade appears on a sealed holder with the coin. This certification provides buyer confidence. Raw coins without grading require more expertise to evaluate. Overgrading by sellers happens frequently in raw coin markets. Certification costs money but often pays for itself through higher resale values. Major grading services maintain online databases of their certified coins.

Tax and Legal Considerations

Precious metals transactions involve specific regulations. The IRS considers rare coins collectibles for tax purposes. Capital gains from sales may apply when you profit. Holding periods affect tax rates on gains. Short-term gains face higher rates than long-term gains. Some states charge sales tax on coin purchases. Others exempt precious metals from taxation. Large cash transactions require reporting under federal law. Purchases over $10,000 in cash trigger reporting requirements. Working with established dealers ensures proper compliance. Keep detailed records of all purchases and sales. These documents prove cost basis when calculating gains. Consult a tax professional familiar with precious metals for specific guidance.

Final Verdict on Rare Silver Investment

Rare silver coins offer a compelling investment option for many people. They combine precious metal value with collectible appeal. The rare silver bullion for sale market provides numerous choices for different budgets and interests. When you buy rare silver coins from reputable dealers, you get quality and authenticity. Park Avenue Numismatics stands out as a trusted source with over three decades of experience in the industry. They offer secure transactions and maintain strict privacy standards for all customers. Starting a rare silver collection requires research and patience. But the rewards include potential financial gains and the pleasure of owning historic pieces. Focus on quality over quantity when building your holdings. Buy coins that genuinely interest you within your budget. With the right approach, rare silver coins can become valuable components of your overall investment strategy. The market continues showing strength, making now a reasonable time to begin or expand your collection.